Your Yellow Brick Road To Growing a Successful Practice with Protection Strategies

Powered by the Alliance for Lifetime Income

THE ALLIANCE FOR LIFETIME INCOME is a non-profit 501(c)(6) educational organization that creates awareness and educates Americans about the value and importance of having protected lifetime income in retirement. Through our marketing efforts and creative partnerships with high-profile individuals like Elton John, we’re reaching millions of Americans with the message to go talk to a financial professional about protected income. As a financial professional, this page provides insights from our consumer research to support and further your successful practice. Read on for more.

WHAT

Most financial professionals know that inside their book of business, there are people with challenges and specific needs that could be improved, maybe even solved, with the right conversation. Sometimes all it takes is to look at these situations through a new lens. That’s why the Alliance for Lifetime Income (ALI) created the New Client Conversation Profiles, designed to help you have better discussions with your clients and prospects. You are likely to recognize these people—the profiles are based on real-life cases and represent the most common opportunities for protected income strategies.

WHY

The New Client Conversation Profiles are designed to assist in conducting better client meetings. Better meetings mean higher engagement. Greater insights mean deeper understanding. It all translates to greater acquisition and retention, the cornerstones of a successful practice.

WHO

Read the Alliance’s financial professional article introducing the profiles (PDF). Download the New Client Conversation Profiles (PDF) and compare them to actual people you know. Each of the individual personas can also be downloaded separately. While you review the New Client Conversation Profiles, use this worksheet to write down the names of existing clients who match the best opportunities for protection discussion.

While you know your clients better than we ever will, you can help them determine what kind of an investor they are using our simple investing personality quiz. Share it with clients to help you determine how best to tailor protection planning for their specific needs.

Starting the conversation

HOW

You’ve built a great plan with your clients. But it’s time to start thinking more about protecting their portfolio and making their income last the rest of their life. So, how do you start the protection conversation with clients? We have tools that can help.

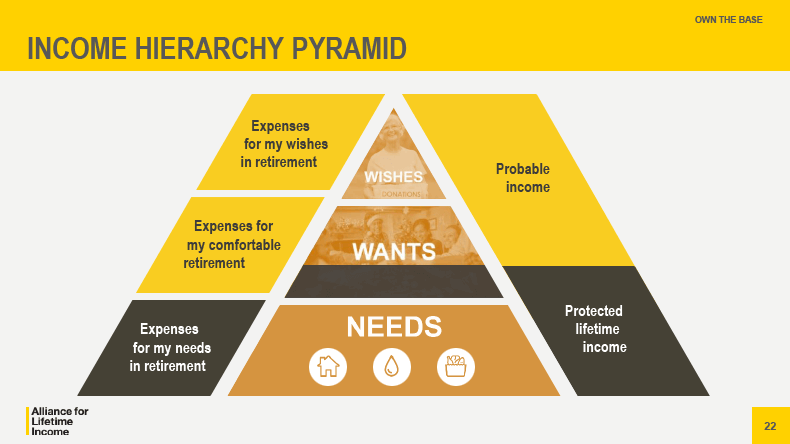

Income Hierarchy Pyramid handout

This FINRA-reviewed handout can help you separate needs, wants and wishes with clients to start the income planning conversation. What are client needs, and how much of those needs will social security cover? Is there a gap? Protection products can help fill that gap, and offer protected income to cover some of their wants as well.

Income Hierarchy Pyramid (PDF)

FINRA Letter (PDF)

Check Off the Basics brochure

Do your clients want time to consider options before making decisions? Do they like to read and do their homework? This brochure helps clients understand the role of protection products and annuities in a portfolio. Send this brochure and encourage clients to schedule a meeting once they’ve read it.

Check Off the Basics (PDF)

FINRA Letter (PDF)

Three Keys to Income Planning client presentation

Are you a natural presenter? Do you like to gather clients and prospects to engage on new approaches and ideas that set you apart as the financial professional to guide them through retirement? We have a FINRA-reviewed presentation for you.

Three Keys to Income Planning and Answering, “What’s Next?” (PPT)

FINRA Letter (PDF)

Having better conversations

You’ve scheduled the meeting to discuss how to effectively shift a plan to include a greater focus on protection. How can you ensure that conversation is productive, and your clients leave satisfied that you’re helping them reach their goals? Alliance research can help.

Emotions play a critical role in decision-making. The way a client feels about a discussion, a strategy, or their advisor can greatly impact the choices they make. As an advisor, you need to engage those emotions to help clients make the right decisions for their situation.

To learn more, read Understand the Role of Client Emotions When Talking About Retirement (PDF)

Eliminate confusing jargon to improve conversations

Protection products like annuities can be difficult to understand, so we’ve created this personalized Language Glossary to help demystify some of the language used when describing products. By reducing this complexity, one can make better decisions, leading to better outcomes in retirement planning. This glossary is based on consumer feedback about what makes sense when describing features, benefits and strategies around protecting portfolios.

Find more educational, FINRA-reviewed Alliance content below to start having protection conversations with clients today:

Download the full presentation, Your Yellow Brick Road to Growing a Successful Practice with Protection Strategies (PPT).

Want to learn more? Download and review this Alliance presentation with handout notes and an educational commentary guide.

The New Client Conversation: Financial Security and the Keys to Effective Decision-Making (ZIP)

For questions on this content, please email jon@alincome.org.